As dedicated parents, we often worry about our children’s future, particularly regarding the inheritance we leave them. A significant concern is ensuring that this inheritance remains protected, especially against any marital disputes or divorces. In this guide, we delve into effective estate planning methods to secure your child’s financial wellbeing, including how to leave money to your child but not their spouse below.

Navigating the Complexities of Marital Property in Divorce

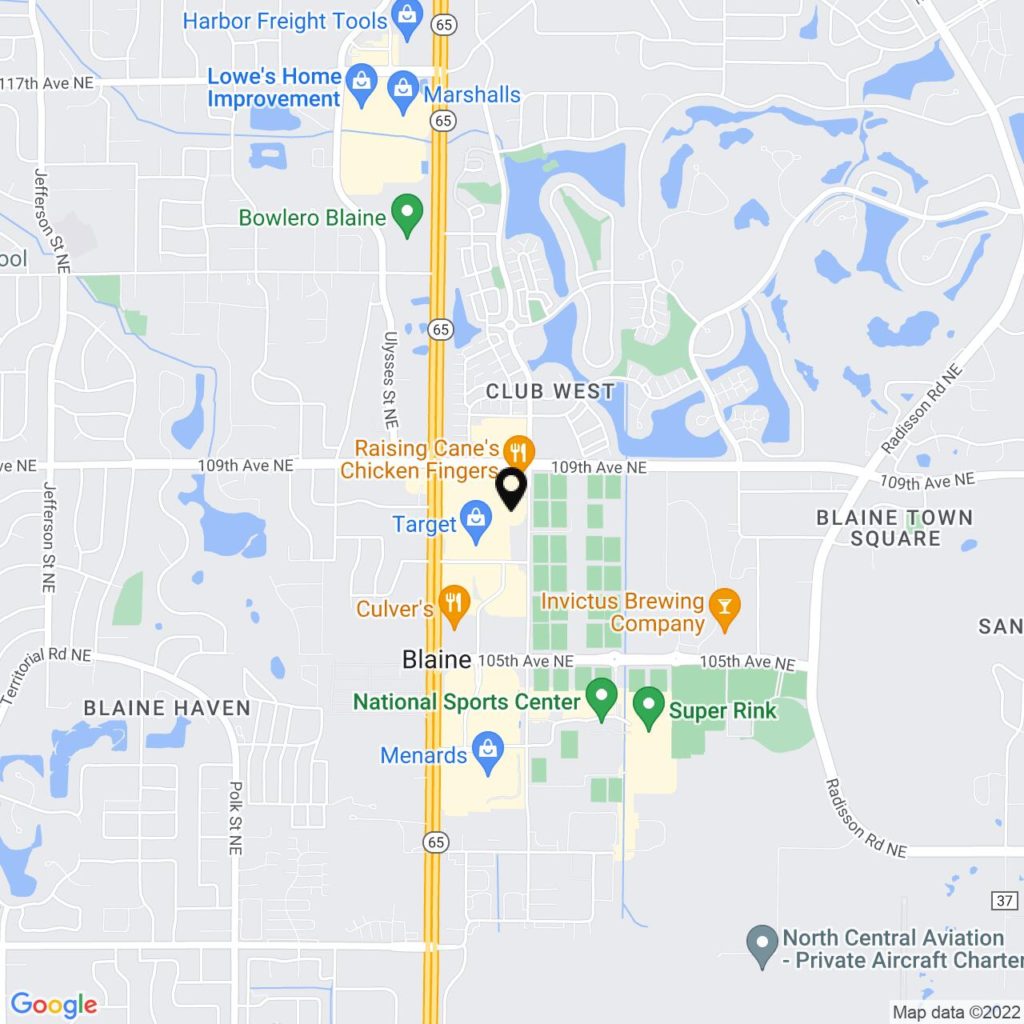

In Minnesota, the law considers marital assets for equitable distribution during a divorce. Typically, this approach could include inherited funds as marital property. Consequently, these funds might be subject to division. At Johnson/Turner, we specialize in helping you safeguard your child’s inheritance from such scenarios.

Avoiding the Pitfalls of Direct Inheritance

Directly leaving a large sum to your child through a will or gift may inadvertently expose these funds to division in the event of a marital split. Unless you take specific precautions, such assets could merge into the marital estate, becoming accessible to the spouse and divisible upon divorce.

Utilizing Trusts to Fortify Asset Protection

Setting up a trust is an effective estate planning strategy. By transferring assets into a trust, managed by a reliable trustee, you can control how and when your child receives their inheritance. More importantly, assets in a trust are generally safe from division in a divorce. They belong to the trust, not your child directly. However, be aware that distributions from the trust to your child could still factor into marital asset division.

Crafting Customized Solutions for Your Family

Every family’s situation is distinct, and so are their needs. At Johnson/Turner, we offer tailored advice and design an estate plan that reflects your specific concerns and objectives. Whether it involves creating a trust or exploring other legal options, our team is committed to protecting your legacy and your child’s financial security.

Mastering the nuances of estate planning and asset protection demands thoughtful strategy and legal know-how. By recognizing potential risks and implementing appropriate measures, you can ensure that your child’s inheritance stays secure, even amidst life’s unpredictable challenges. If you need help deciding how to leave money to your child but not their spouse, contact us today.